17 Sep Private Sector Payroll Protection Program for Puerto Rico

The Puerto Rico Treasury Department has recently announced new incentives for the private sector through a new round of Paycheck Protection Program (PPP) loans for small businesses, providing more than $350 million to help mitigate the deep financial impact of the COVID-19 emergency.

ELIGIBILITY REQUIREMENTS

-

- Private employer;

- Less than 500 employees;

- Annual gross income of $10,000,000 or less;

- Must have been in operation on March 15, 2020, with employees for whom it paid salaries and payroll taxes;

- Be duly registered in the Merchants Registry;

- Have incurred or planned to incur in necessary expenditures related to the COVID-19 emergency and maintain documentation that demonstrates the expenses;

- Confirm that funds under PPP will be used for expenses not covered or reimbursed, and will not be covered in the future, by other state, federal, or private programs;

- Retain employment levels at the same level on the date of application under this Program for no less than eight (8) weeks after receipt of funds from this Program.

- Have not participated in the PPP of the SBA or plan to participate in the future

ALLOWABLE EXPENDITURES

-

- Employees salary, wages, commissions, or similar compensation;

- Cash tips or the equivalent (based on employer records of past tips, or, in the absence of such records, a reasonable, good-faith employer estimate of such tips);

- Payment for vacation, parental, family, medical, or sick leave; and

- Payment for the provision of employee benefits consisting of group health care coverage, including insurance premiums, and retirement.

INELIGIBLE EXPENDITURES

-

- Necessary expenses covered or reimbursed, or will be covered in the future, by another state, federal, or private insurance programs that the Applicant may have;

- Any compensation of employee whose principal residence is outside PR;

- Compensation of an employee in excess of an annual salary of $100,000, prorated as necessary;

- Federal employment taxes imposed or withheld, including the employee’s and employer’s share of FICA and Railroad Retirement Act taxes, and income taxes required to be withheld from employees;

- Qualified sick and family leave wages for which a credit is allowed under sections 7001 and 7003 of the Families First Coronavirus Response Act

- Employee bonuses;

- Severance pay; and

- Executive bonuses, debt refinancing, or other expenses that are determined to be unnecessary for continued operations in the COVID-19 environment.

FPVG INSIGHTS

-

- Non-Profits are eligible for the program if the organization is duly certified by the Puerto Rico Department of Treasury.

- If the business started operating after March 31, 2019= Q2 Net Income for 2019 will be substitute by the Net Income from the first three months of operations at 2019.

- If the business started operating between December 31, 2019 and March 31, 2020, it should only calculate the Industry and Employee Reduction.

Program Guidelines – Published September 13, 2020

Source: Private Sector Payroll Protection Program (PPP)

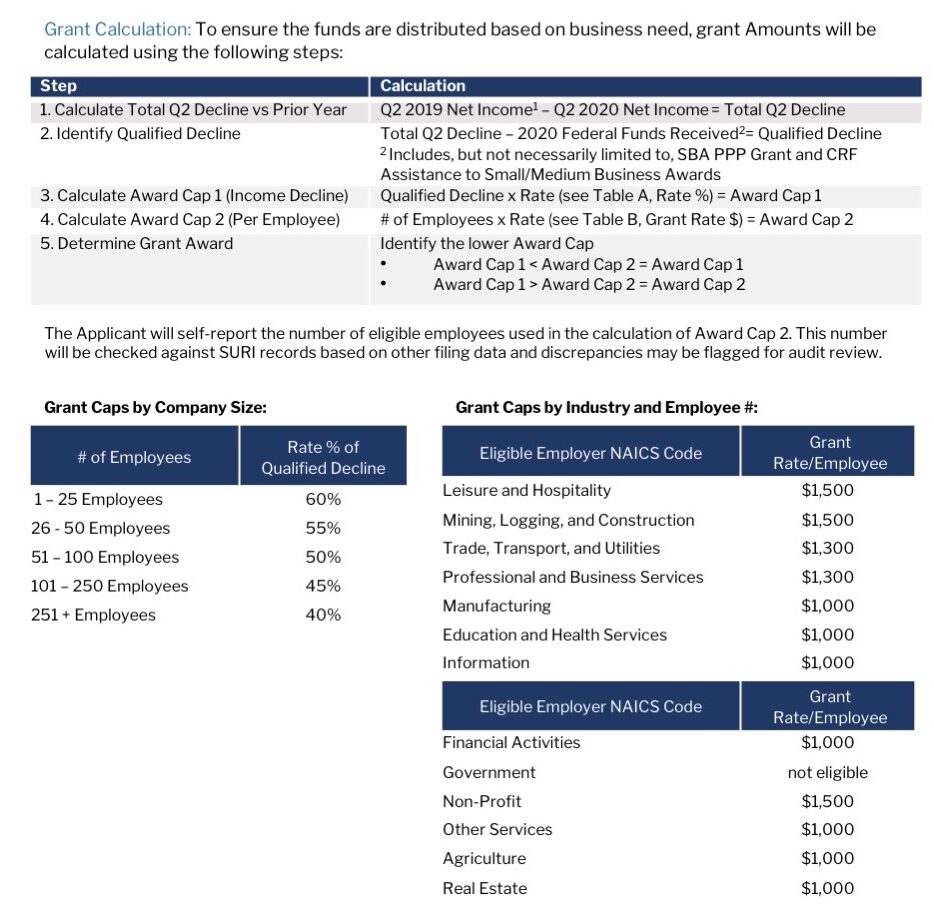

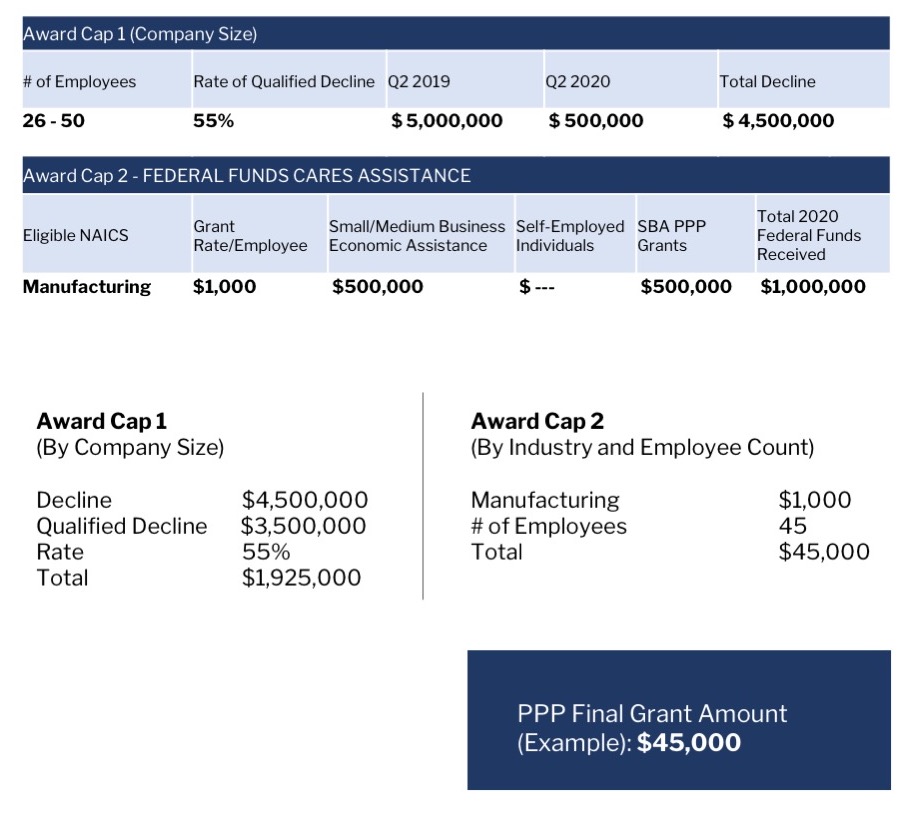

PPP Grant Calculation Example: Manufacturing Business with 45 Employees

Q-2, 2019 Net Income = $5,000,000 versus Q-2, 2020 Net Income = $500,000

Total awarded Federal Funds, including Federal SBA PPP = $1,000,000

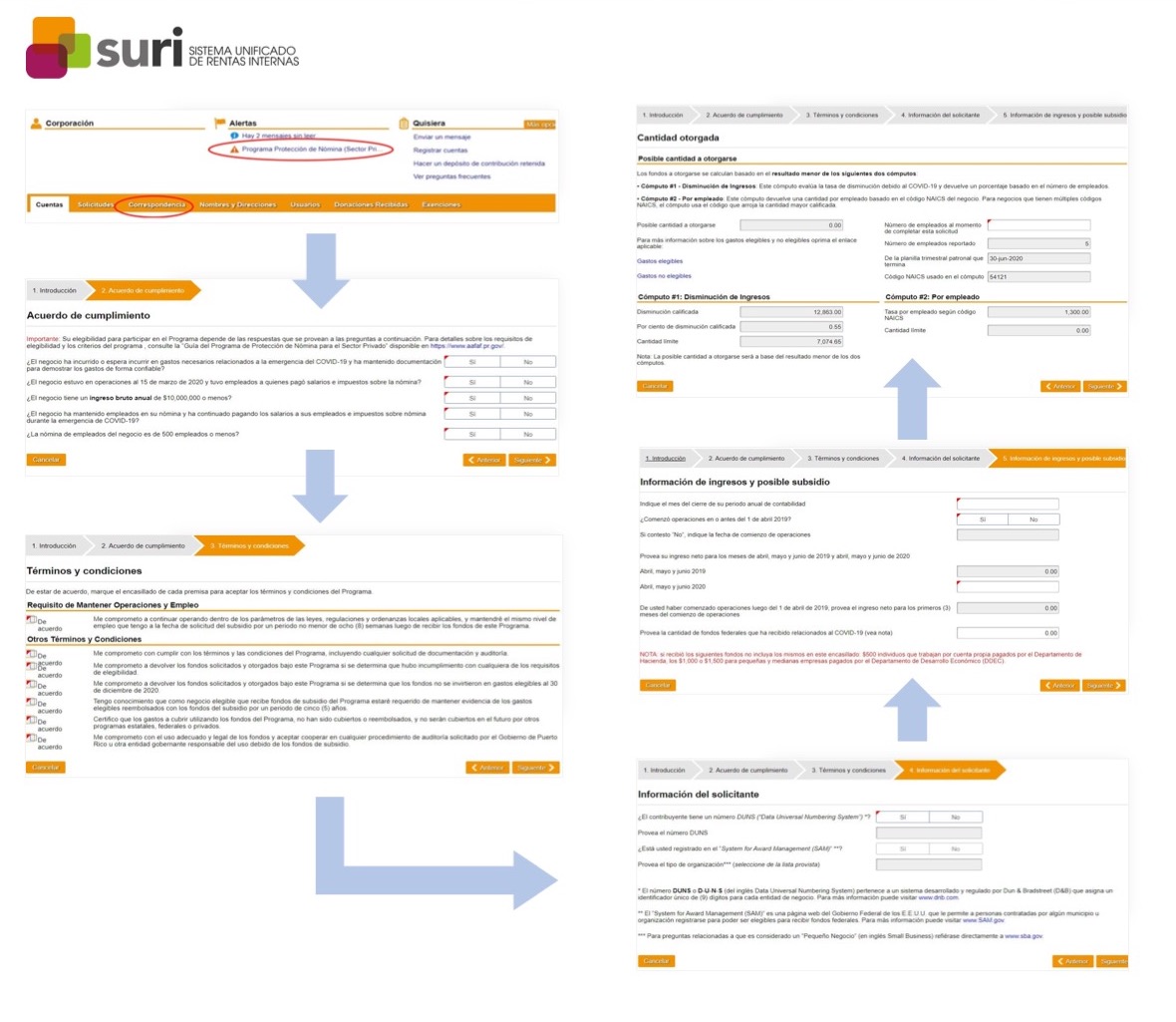

Online Application Instructions

If you need any help navigating these programs, your trusted team of advisors at Galíndez LLC is ready to provide assistance:

info@galindez.com | (787) 725-4545