25 Jan Galíndez Insights: Kicking Off Our 2024 In-House Seminars

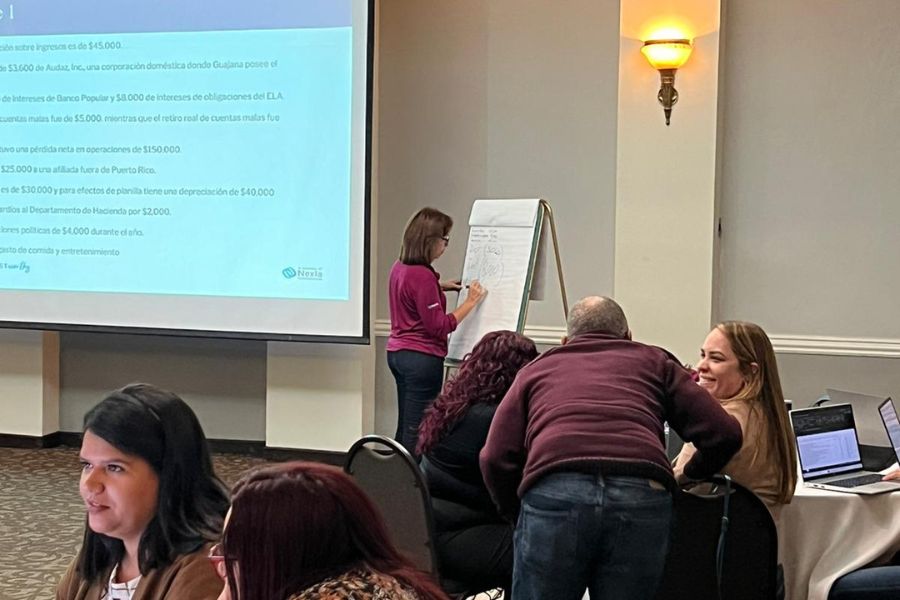

Galíndez LLC kicked off the 2024 seminar series with its first in-house seminar at Chavales Restaurant Banquet Hall. Led by Partner Kenneth Rivera, CPA, Esq., Senior Tax Manager Yelitza Net Ferrer, CPA, and Tax Supervising Senior Eric Gotay, the “Tax Refresher 2023” presentation covered crucial topics like corporation income tax computation, financial statements vs. tax returns, and more. The second presentation, “Benefit Ownership Information,” led by Partners Kenneth Rivera and Iris Otero, CPA, Esq., delved into general concepts, filing requirements, and exemptions. Attendees were invited to test their skills with some practical exercises and also earned CPA credits, gaining valuable insights to tackle the upcoming tax season confidently.

At Galíndez LLC, commitment to training is ingrained in our culture. We prioritize our staff, making their continuous learning a top agenda item. This dedication to ongoing education enriches our team members and directly benefits our clients. By ensuring our professionals stay updated and well-versed in the latest industry insights, regulations, and techniques, we maintain a standard of excellence that translates into superior service for our clients. Our commitment to staff development is a crucial pillar in our mission to be a #trustworthy partner for all your accounting and consulting needs.

To access this seminar, please request your access code, as the presentation is password-protected.