03 Feb Galíndez LLC Kicks Off 2025 With Comprehensive Tax Update for Team

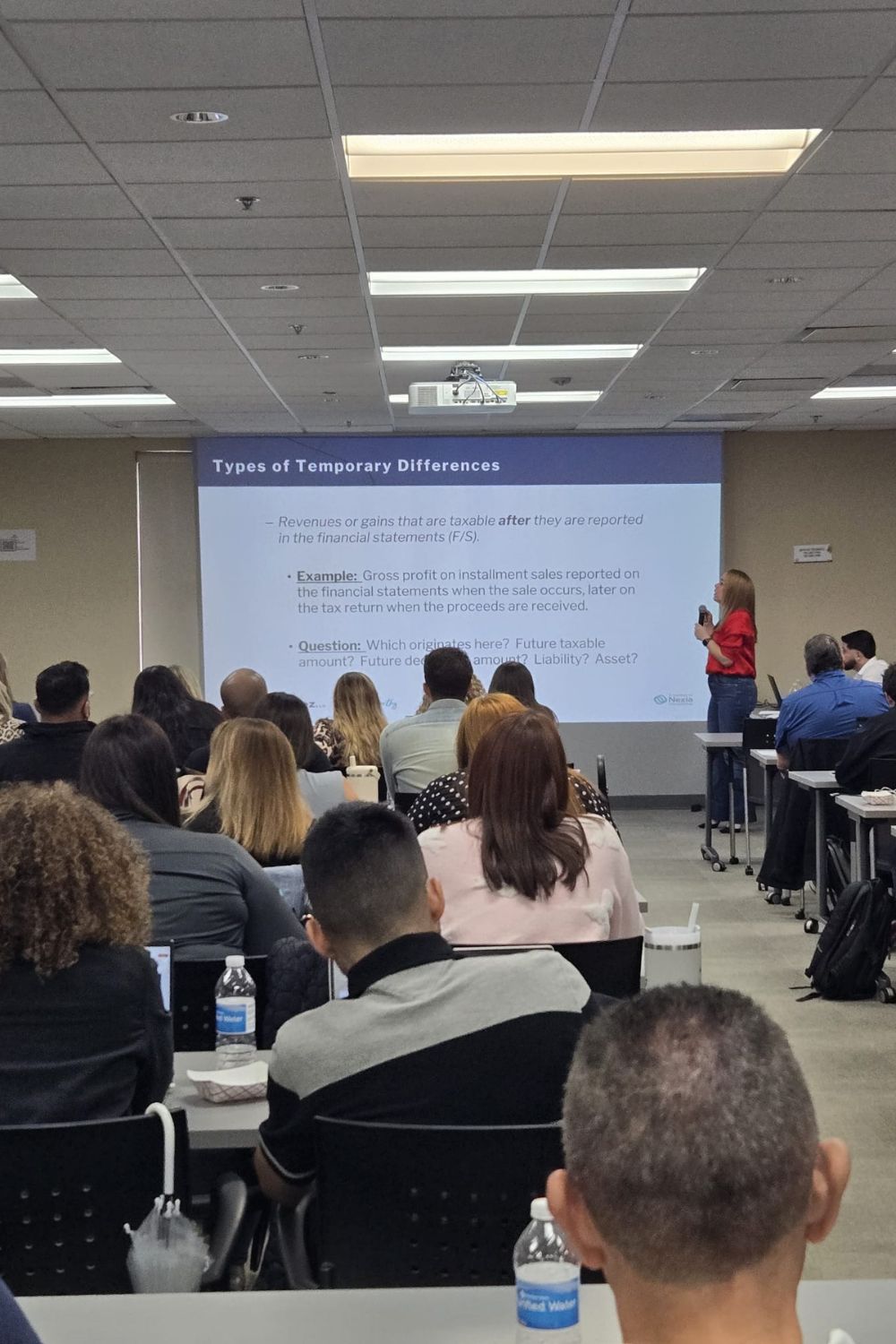

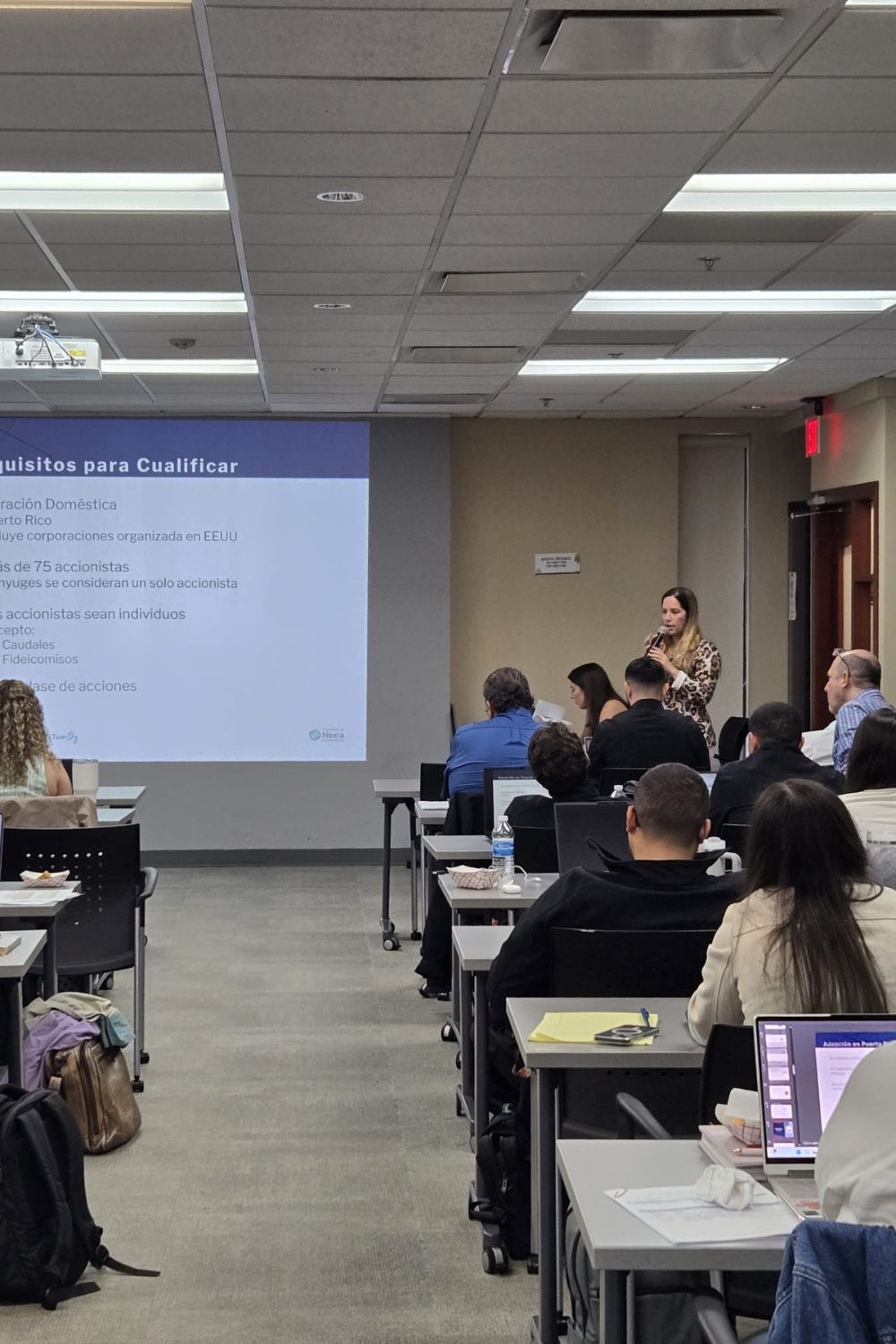

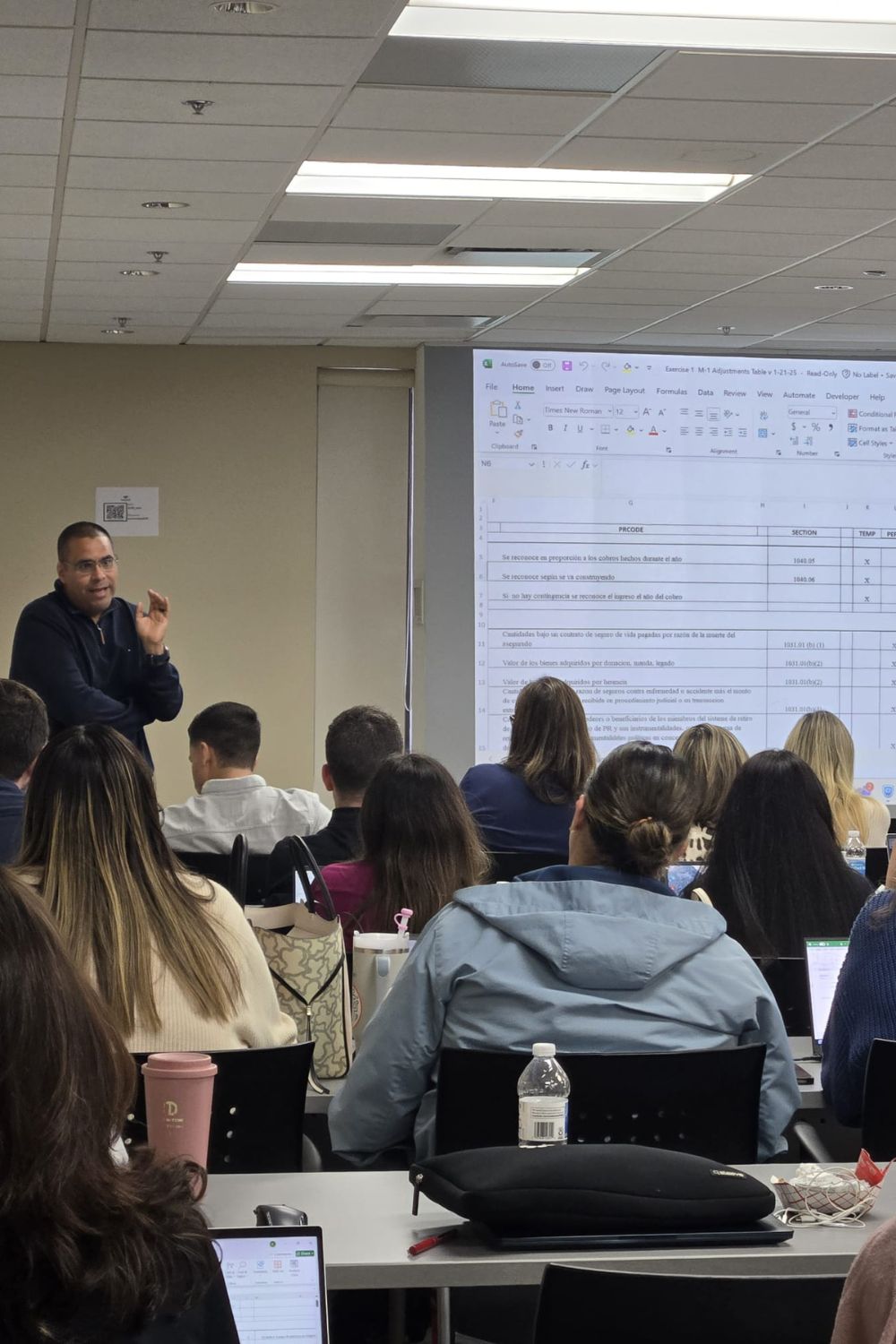

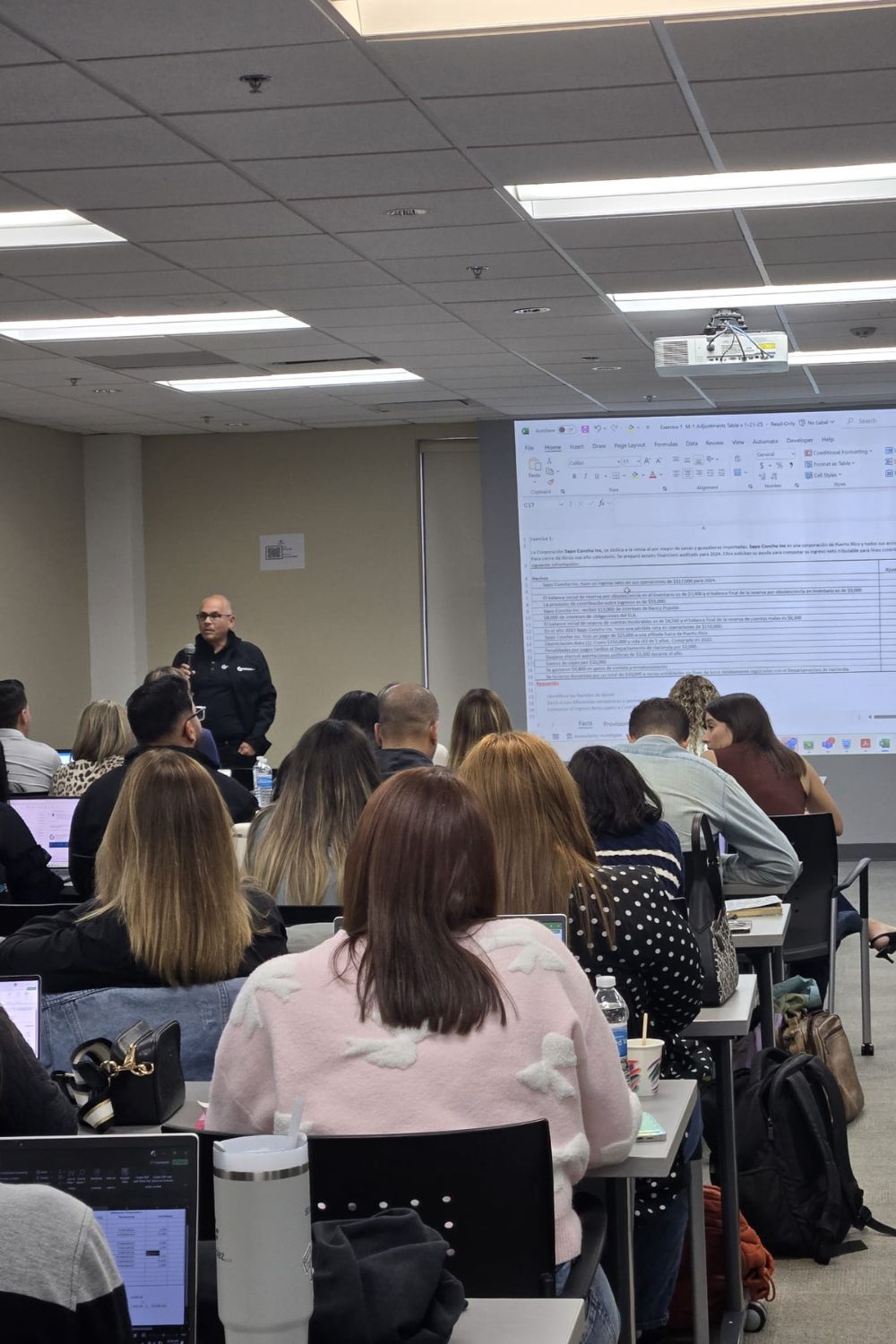

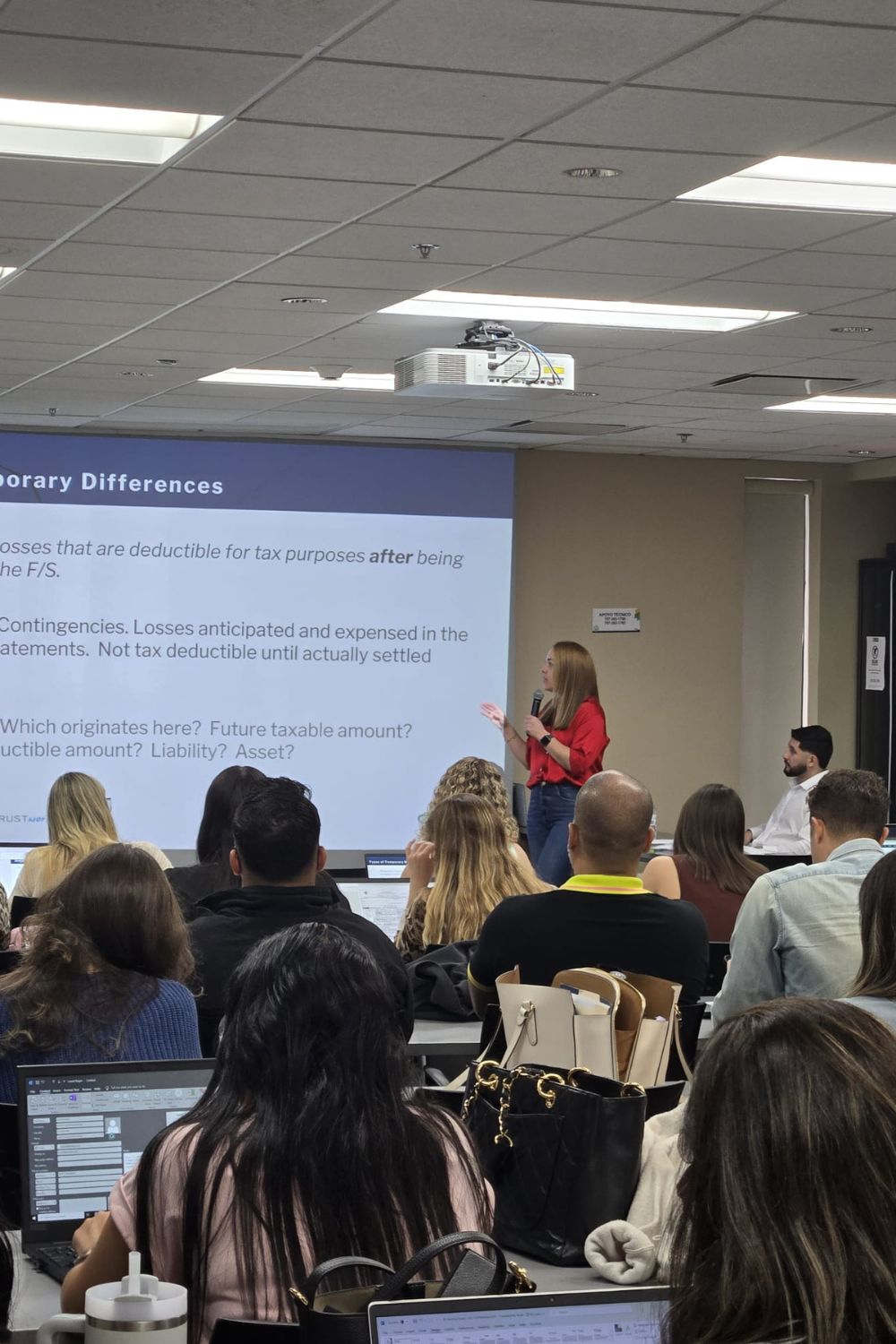

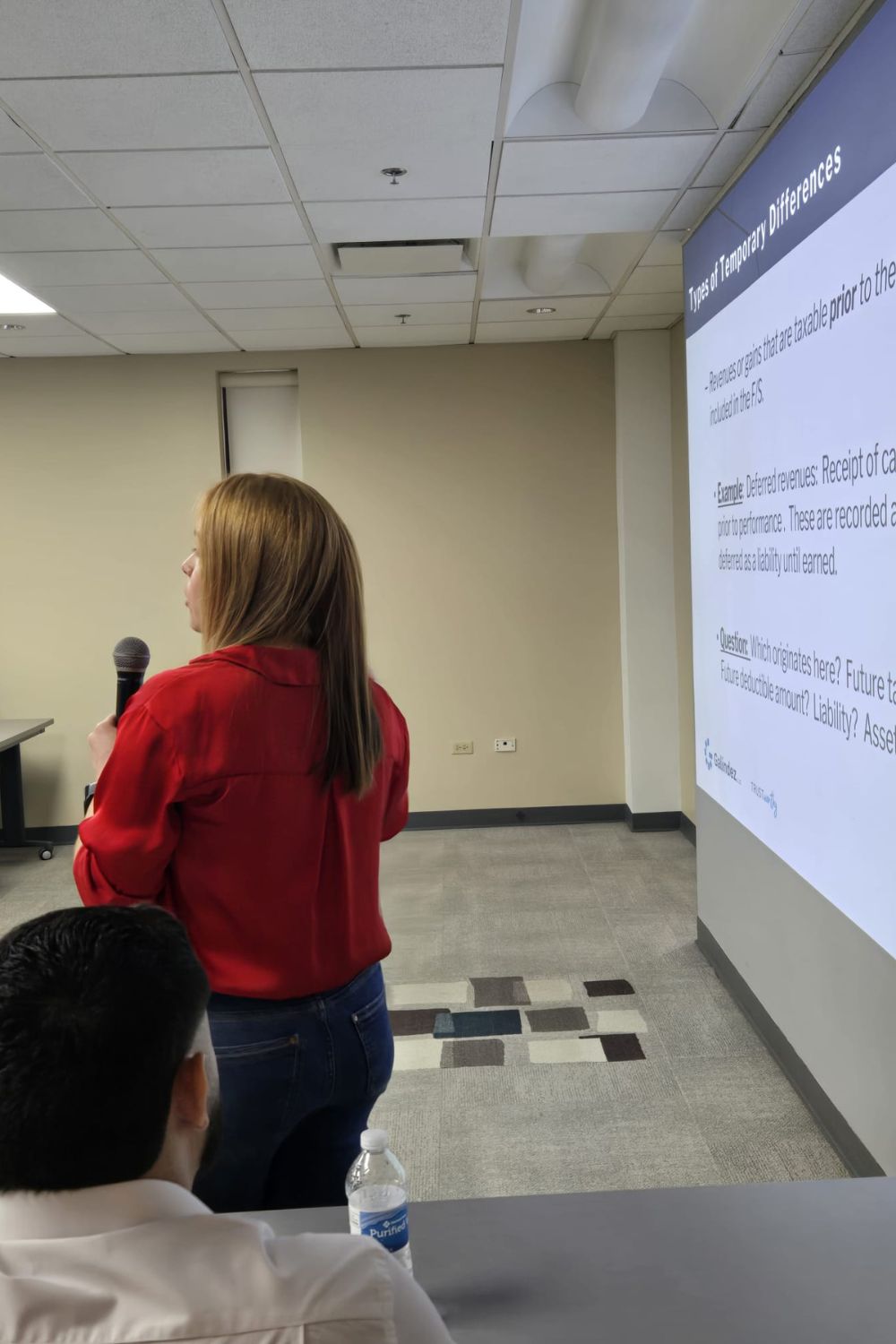

As we head into one of the tax industry’s busiest times of the year, Galíndez LLC is committed to ensuring our team is equipped with the latest knowledge and insights. We recently kicked off 2025 with a thorough review of key tax updates held at the Universal University facility.

The event, presented by managers, supervising seniors, and the Galíndez LLC Tax Department seniors, with the support of Tax Partner Kenneth Rivera, provided eight hours of continuing professional education (CPE) credit. The comprehensive overview included four specific presentations designed to cover the most pertinent updates and refreshers:

- 2024 Tax Update for Individuals

- Update on aspects of taxes for nonprofit organizations

- 2024 Corporate tax refresher

- Conduit Entities 2024 Refresher

Staying up-to-date on the ever-evolving tax landscape is crucial for several reasons. For our clients, it means accurate, informed, and strategic advice that minimizes their tax burden and maximizes their financial well-being. Our team’s deep understanding of the latest tax laws and regulations allows us to identify opportunities, navigate complex situations, and provide proactive solutions tailored to each client’s unique needs.

Continuous learning is essential for our team members’ professional growth and career advancement. These updates empower our professionals to enhance their expertise, expand their skill sets, and stay at the forefront of the industry.

By investing in our team’s development, we are investing in the future of Galíndez LLC and our ability to serve our clients at the highest level. This commitment to ongoing education is a cornerstone of our firm’s values and reflects our dedication to excellence. We believe that a well-informed team translates directly into exceptional client service and strengthens our position as a trusted leader in the tax industry.

To learn more, please contact us: info@galindezllc.com