06 Jun Galíndez Team Advances Tax Expertise at Spring Update Seminar

On May 27, 2025, members of the Galíndez team participated in a comprehensive Spring Tax Update seminar designed to keep professionals at the forefront of evolving tax regulations and international reporting standards. This educational event is part of our ongoing commitment to professional excellence and to delivering exceptional insight to our clients across industries.

The day-long seminar covered a range of critical topics that continue to shape the financial landscape, starting with an in-depth look at the legal and tax consequences of estates presented by Andrea Martínez. Following this, Alexander Remy explored the intricacies of trust concepts and return strategies, offering valuable guidance for effective wealth management.

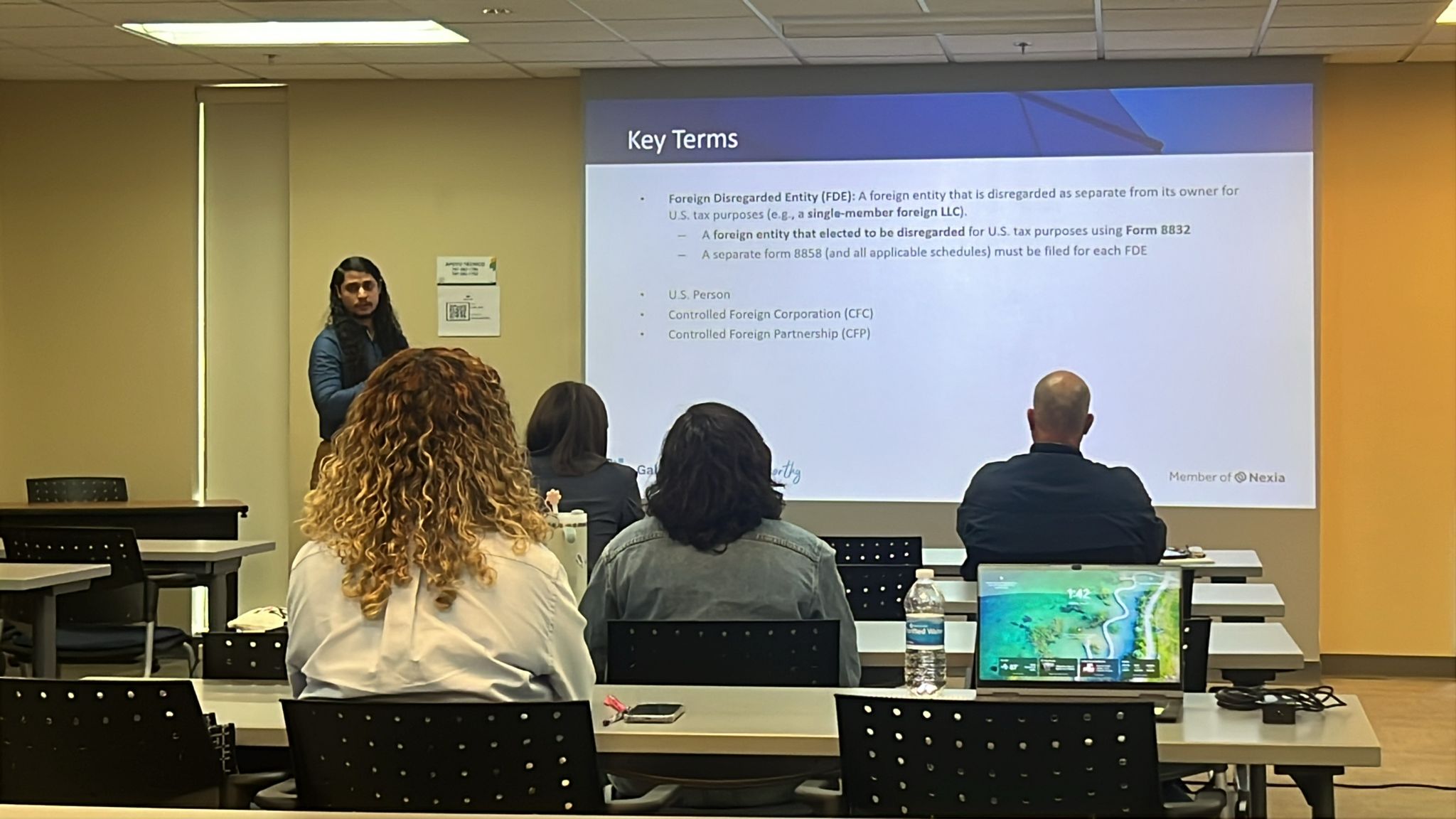

After the midday break, attendees reconvened for an intensive session on foreign entity compliance. Vijay Toolsie addressed default rules for foreign entities, a subject of increasing relevance for clients with cross-border operations. Andres Rosa followed with a session on foreign investment reporting rules, underscoring the importance of transparency and compliance in an era of globalized finance.

In the final sessions of the day, Rafael Gutierrez examined Controlled Foreign Corporations (CFCs) and deemed dividend rules, while Ashley Cruz concluded with a thorough discussion on Subpart F Income and Global Intangible Low-Taxed Income (GILTI), both vital topics for multinational tax planning.

At Galíndez, we recognize that staying informed on current tax legislation and international standards is essential to providing sound, forward-thinking advice. Attending events like the Spring Tax Update reflects our firm-wide dedication to continuous learning and our proactive approach to serving client needs.

We are proud of our team’s commitment to staying ahead of the curve—ensuring our clients benefit from strategies rooted in the latest regulatory knowledge and industry best practices.