05 Feb Ongoing Tax Training to Support Quality Service at Galíndez LLC

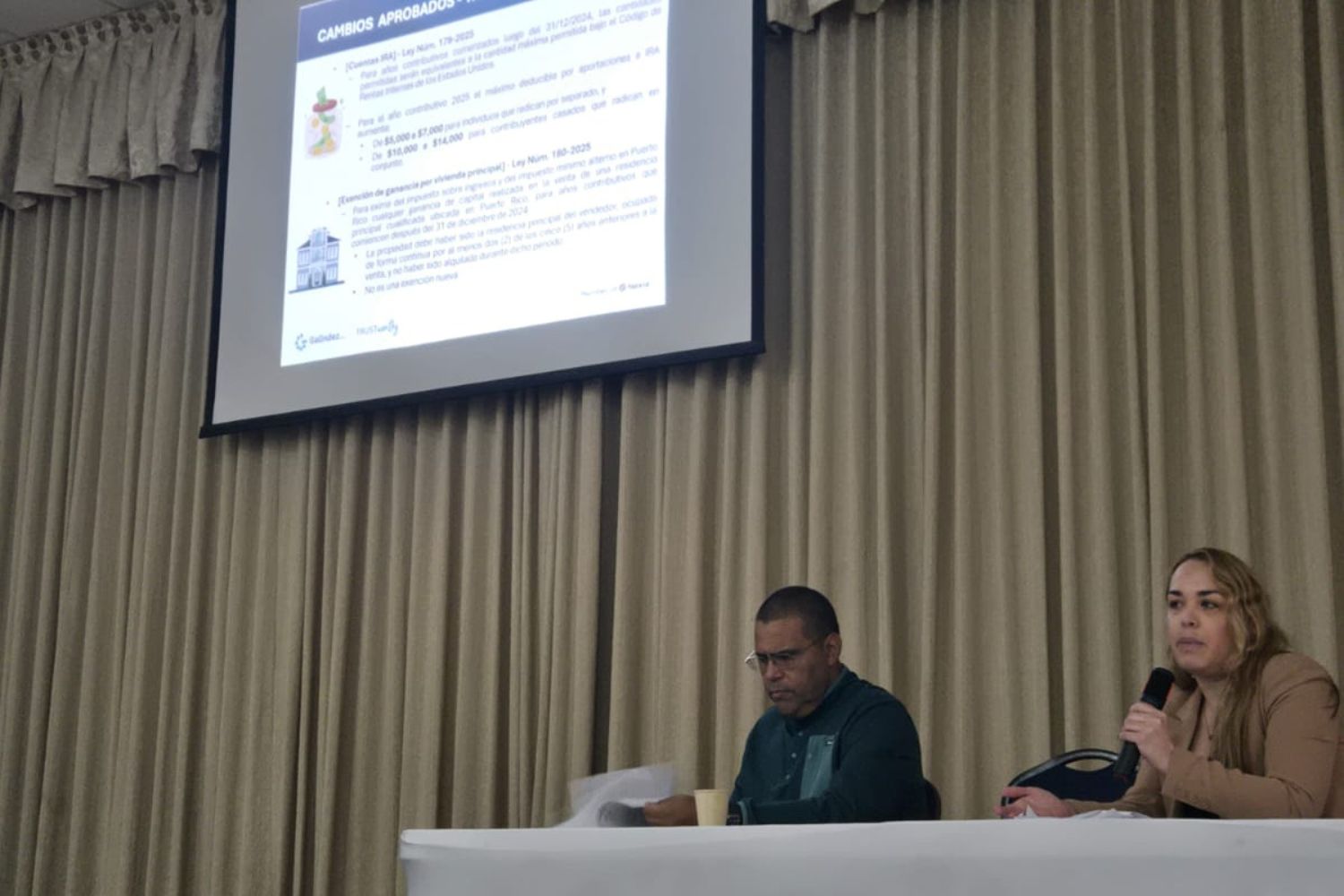

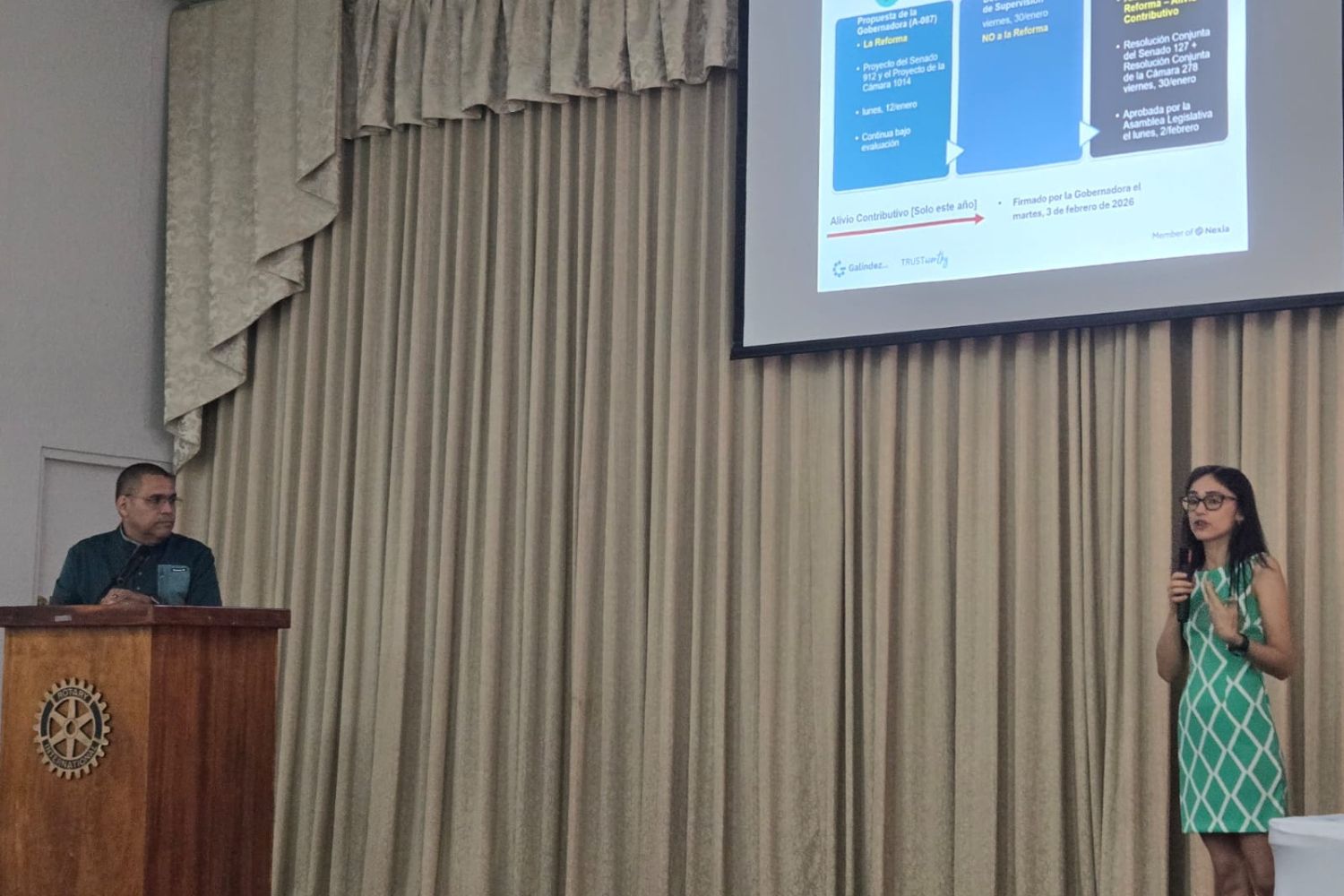

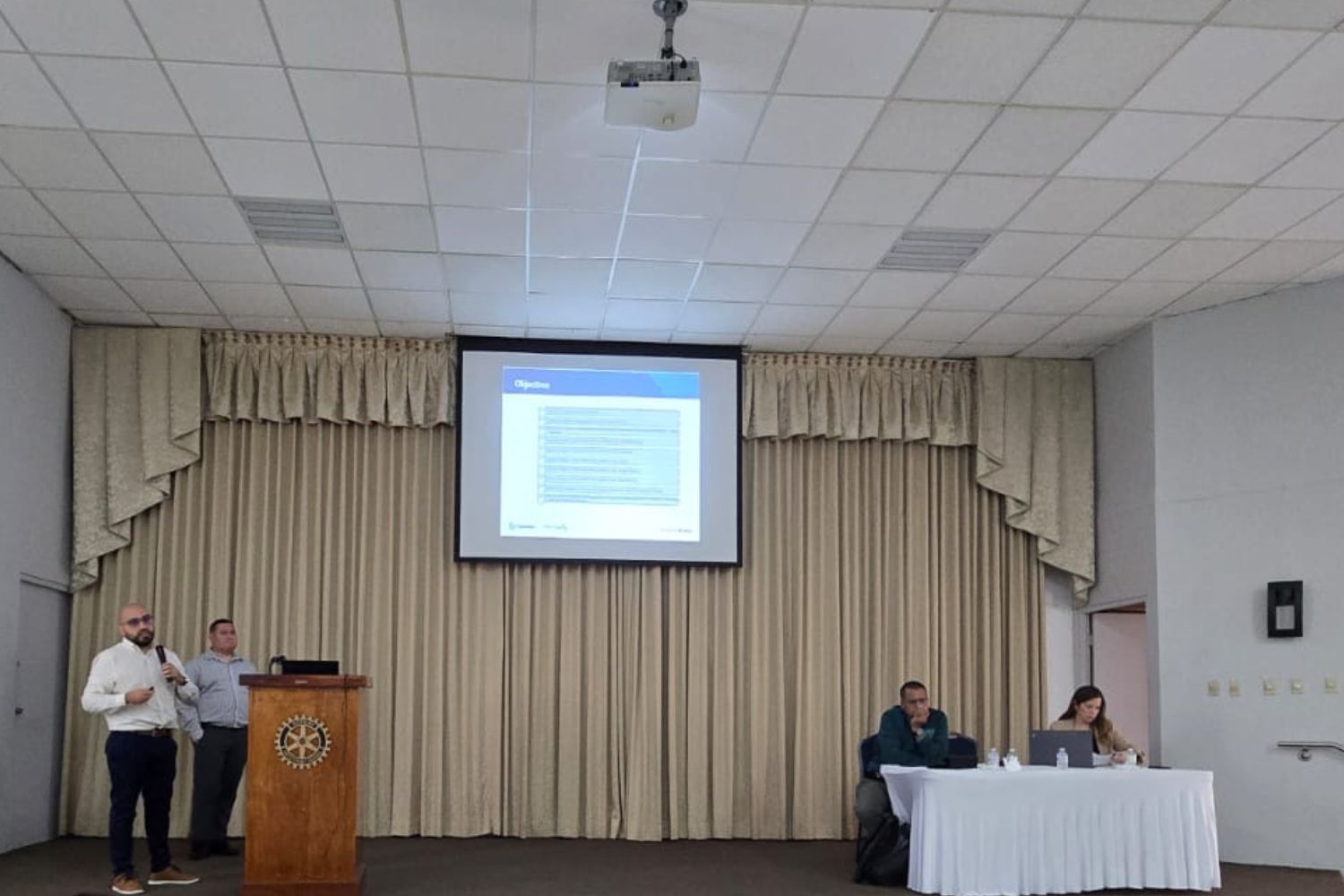

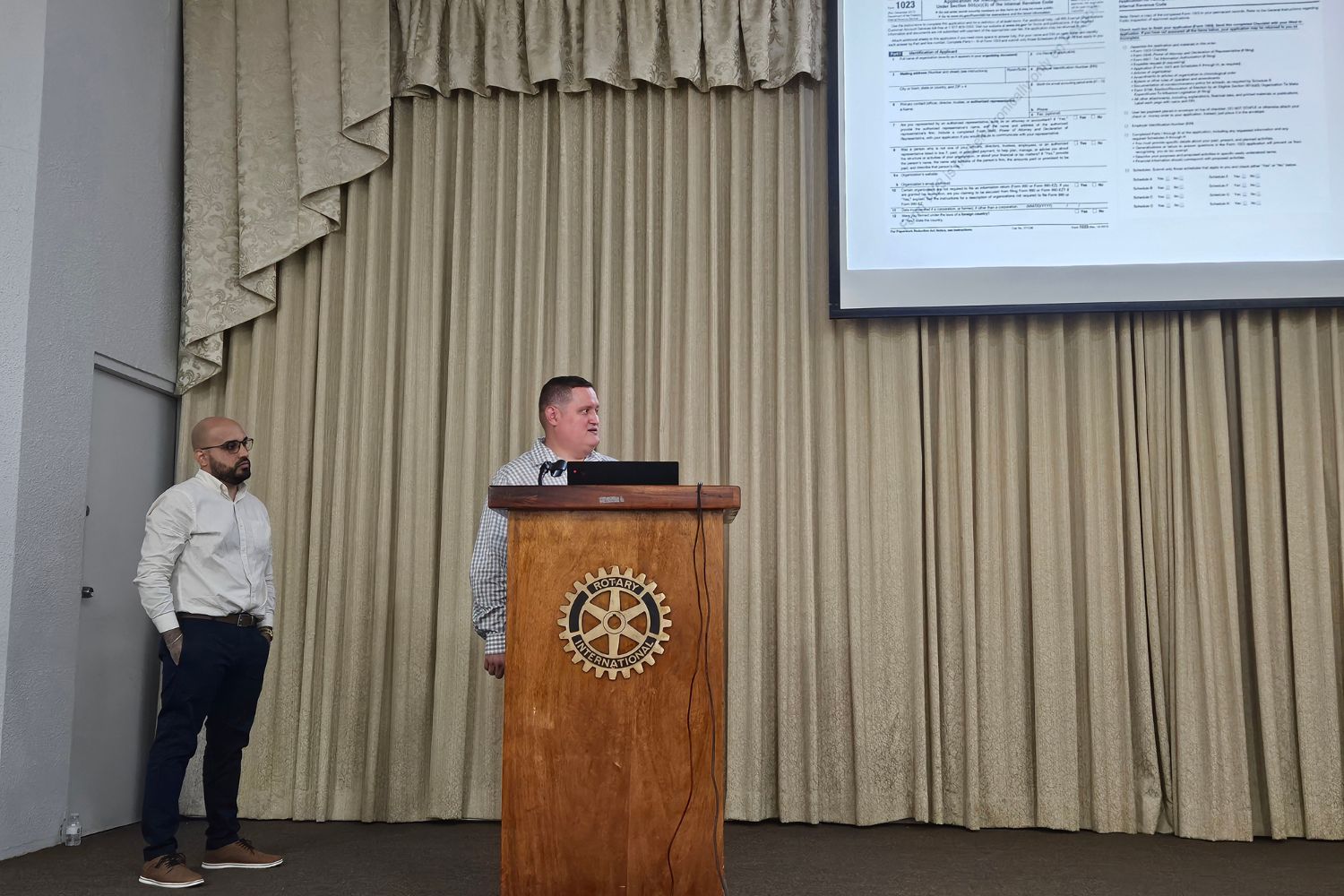

Even at the height of Puerto Rico’s tax season, Galíndez LLC continues to prioritize education, preparation, and technical excellence. Recently, the firm held an in-house tax update seminar at the Club Rotario de Río Piedras, bringing together its Tax Department members for a comprehensive review of key developments affecting the current filing season.

This training reflects Galíndez LLC’s ongoing commitment to ensuring that its professionals remain informed, compliant, and well-equipped to deliver high-quality service in an increasingly complex tax environment.

Addressing the issues that matter this tax season

The seminar focused on several critical areas directly affecting Puerto Rico’s 2025–2026 tax season, including:

- Recent legislative and regulatory updates affecting individuals and corporations

- Pass-through entities and conduit structures are an area of continued scrutiny and frequent change

- Corporate and individual income tax considerations, including planning opportunities and compliance challenges

- Puerto Rico incentive programs, with emphasis on proper application, documentation, and reporting

- Best practices in tax compliance and planning, particularly in high-risk or frequently reviewed areas

These topics are especially important during tax season, when timely interpretation of new rules and consistent application across engagements can significantly impact compliance, risk management, and client outcomes. Staying current allows the firm’s professionals to anticipate issues, address questions proactively, and guide clients through filing requirements with clarity and confidence.

A collaborative, firm-wide effort

The seminar was presented by a multidisciplinary group from Galíndez LLC’s Tax Department, demonstrating the depth of expertise and collaboration within the firm:

- Kenneth Rivera, CPA – Partner

- Yelitza López, CPA – Manager

- Yelitza Net, CPA – Manager

- Jazmarie Rivera, CPA – Manager

- Edgardo Rosa, CPA – Manager

- Ashley Cruz – Senior

- Arixabel Matos, CPA – Semi Senior

- Emmanuel Báez – Semi Senior

- Orlando Algarín – Senior

- Rafael Gutiérrez – Senior

- Vijay Toolsie – Semi Senior

- Andrés Rosa – Staff

- Dailyn Ortiz – Staff

By sharing insights and practical perspectives, the team reinforced a unified approach to addressing client needs during the year’s most demanding period.

Training as a foundation for quality and trust

At Galíndez LLC, ongoing professional development is not optional — it is fundamental to the firm’s ability to deliver consistent, high-quality service. Making time for structured training during the busy season underscores the firm’s dedication to excellence, ethical standards, and technical rigor.

This commitment ensures that clients benefit from informed guidance, accurate analysis, and a team that remains fully aligned with current tax requirements in Puerto Rico.

If you would like access to the educational presentations or additional information shared during this seminar, please contact our offices, and we will be happy to assist you.