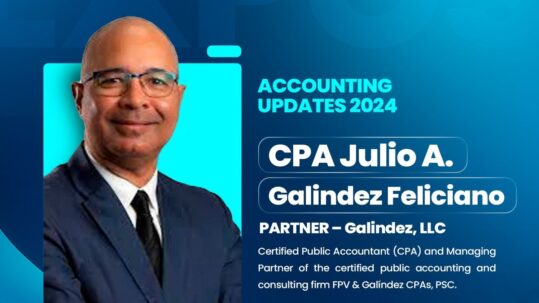

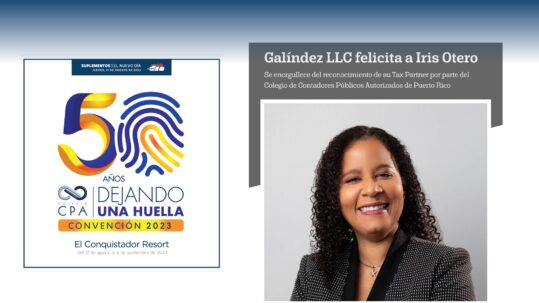

Galíndez LLC at the 37th Foro Contributivo of the Puerto Rico Society of CPAs

For decades, the Puerto Rico Society of Certified Public Accountants (Colegio de Contadores Públicos Autorizados de Puerto Rico) has served as a cornerstone of the accounting profession on the island,...